On the Edge

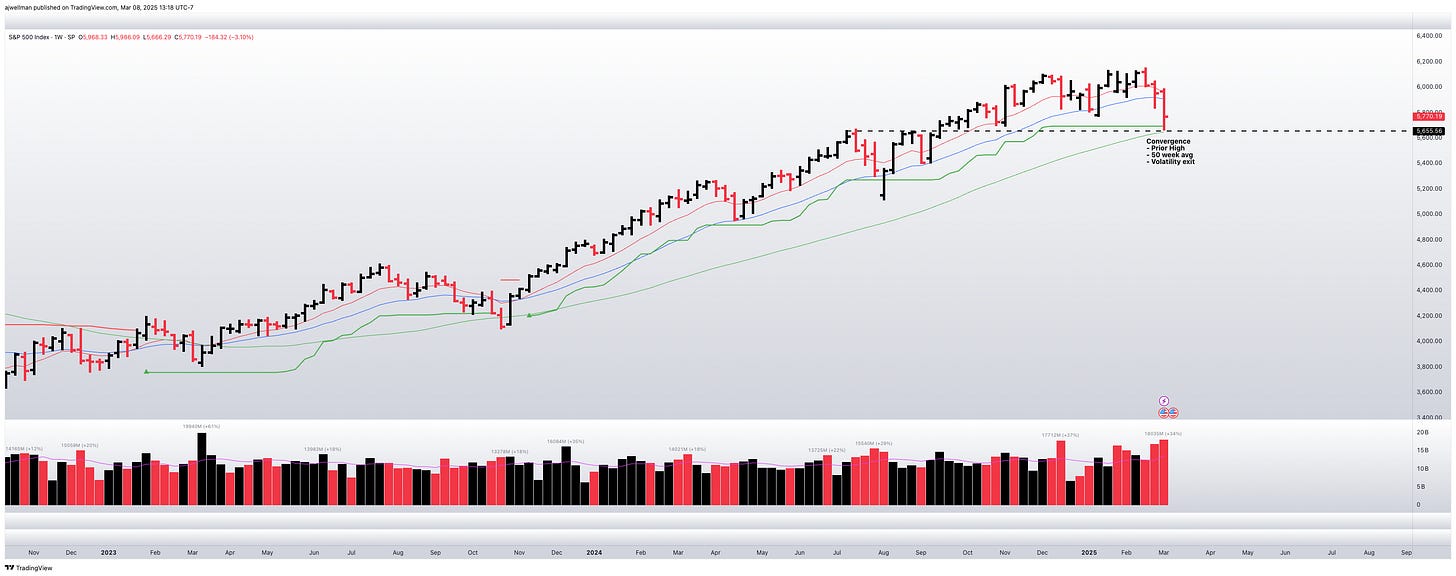

I am switching back to showcasing the S&P 500 this week for the broadest market view. As volatile and painful as the past three weeks have been, the SPX is only down 8% from highest to lowest value in the trend. That falls well within normal fluctuations for a typical market year. We currently sit at convergence of the 50 week moving average, a prior high support, and a volatility based exit known as a chandelier exit. Additional weakness from here would be a very bad sign, particularly if the market spends much time below 5700.

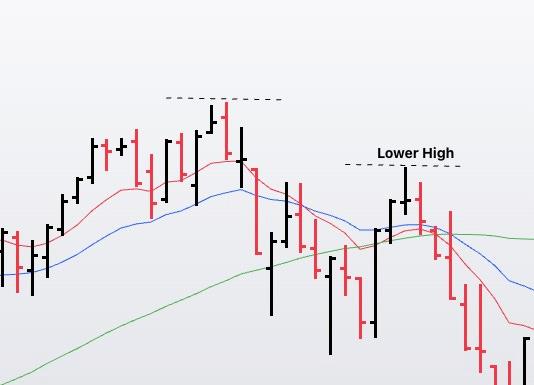

However, a bad market doesn’t usually crash in one move. What would be more concerning is an attempt to rally from here that results in a lower high below 6000. Here is how a similar setup looked in early 2022.

Looking at the bond market, there has been a spike in BAML and rates have come down as money moves to a defensive position in bonds. However, neither of those moves currently suggests anything more than a pullback. We’ll have to watch week-by-week to see if those indicators deteriorate more from here.

I mentioned last week that the market was dealing with “Max Uncertainty”. I found this video interesting to contemplate. There are a litany of factors that market is dealing with: slowing growth, possible recession, cutting of government spending, tariffs, etc.. This shouldn’t really surprise anyone and all those were reasons that I felt this year was likely to be volatile and difficult to trade.

I would say my general lean is that we are near a temporary bottom for Spring (within a few weeks). What is more difficult to predict is what happens as we move into Summer and Fall. Those months are typically much more difficult and the market will likely have absorbed most of the policy and economic news.